texas estate tax calculator

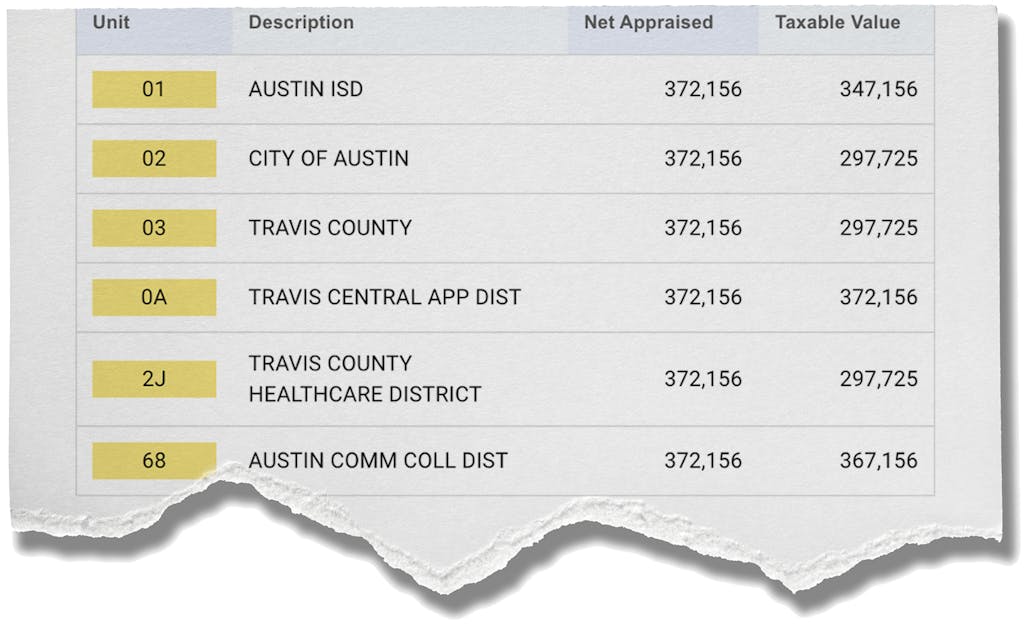

County and School Equalization 2023 Est. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

For comparison the median home value in Dallas.

. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Calculator is designed for simple accounts. Compare that to the national.

There is no state property tax. The exact property tax levied depends on the county in Texas the property is located in. For comparison the median home value in El Paso.

King County collects the highest property tax in Texas levying an average of 506600 156 of. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For comparison the median home value in Austin.

Property taxes are one of the oldest forms of taxation. Counties in Texas collect an average of 181 of a propertys assesed fair. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

For comparison the median home value in Houston. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval. While the state does not appraise property values set property tax rates or collect property taxes they set the operating rules for political subdivisions imposing and administering them.

Enter your Over 65 freeze year. Tax Rate City ISD. Enter your Over 65 freeze amount.

Property tax in Texas is a locally assessed and locally administered tax. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Simply put property taxes are taxes levied on real estate by governments typically on the state county and local levels.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Property taxes in Texas are the seventh-highest in the US as the average effective property tax rate in the Lone Star State is 169. Property tax brings in the most money of all taxes.

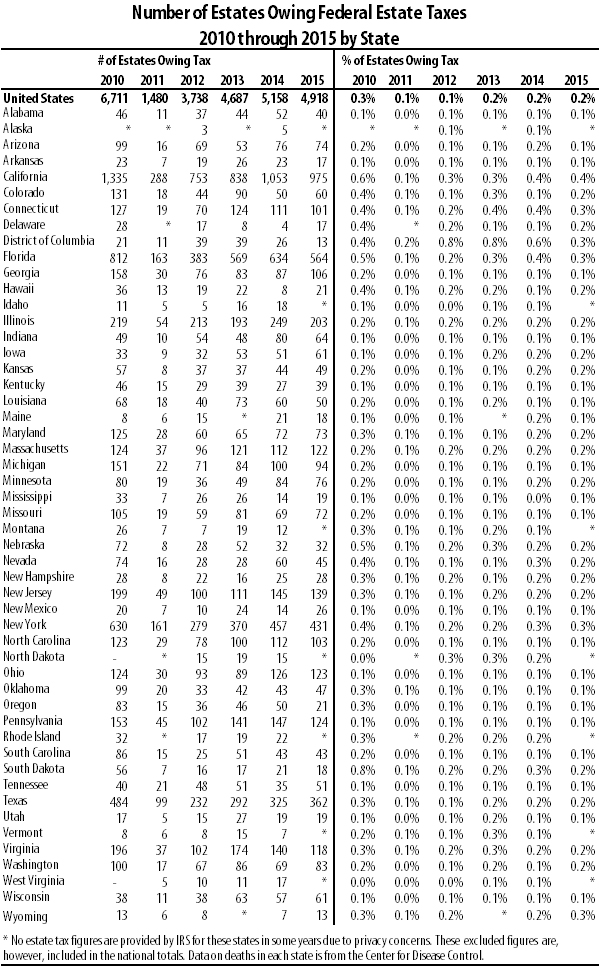

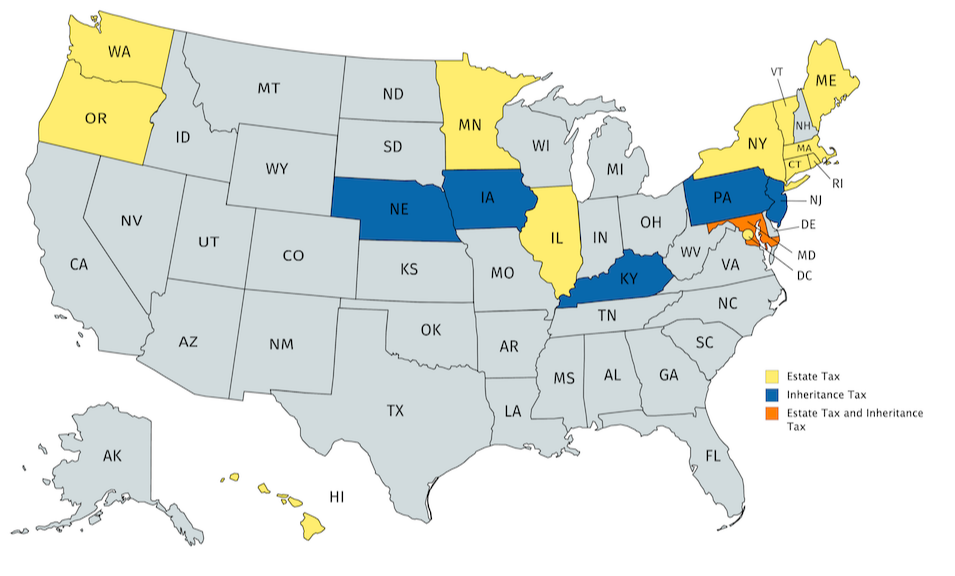

An estate tax is a tax imposed on the total value of a persons estate at the time of their death. It is sometimes referred to as a death tax Although states may impose their own. For comparison the median home value in Texas is.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Illinois Sales Tax Rate Rates Calculator Avalara

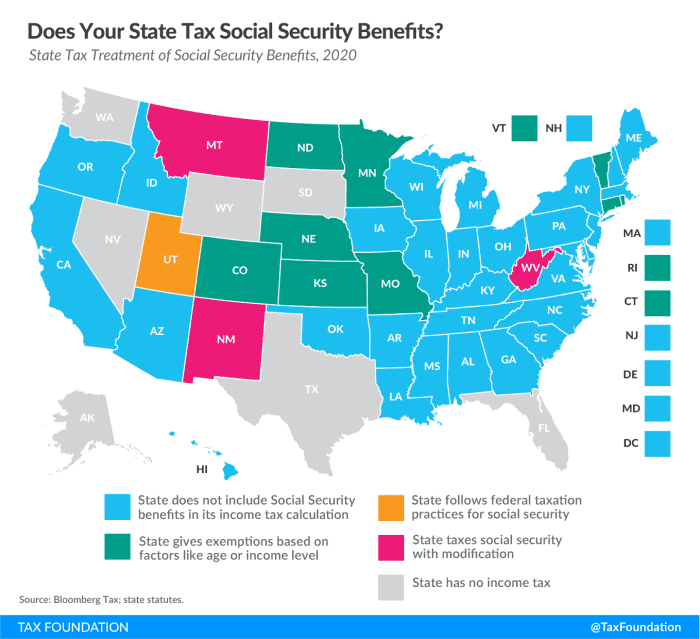

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Texas Property Tax Exemptions To Know Get Info About Payment Help Property Tax Exemptions In Texas Tax Ease

State By State Estate And Inheritance Tax Rates Everplans

How To Avoid Estate Tax For Ultra High Net Worth Family

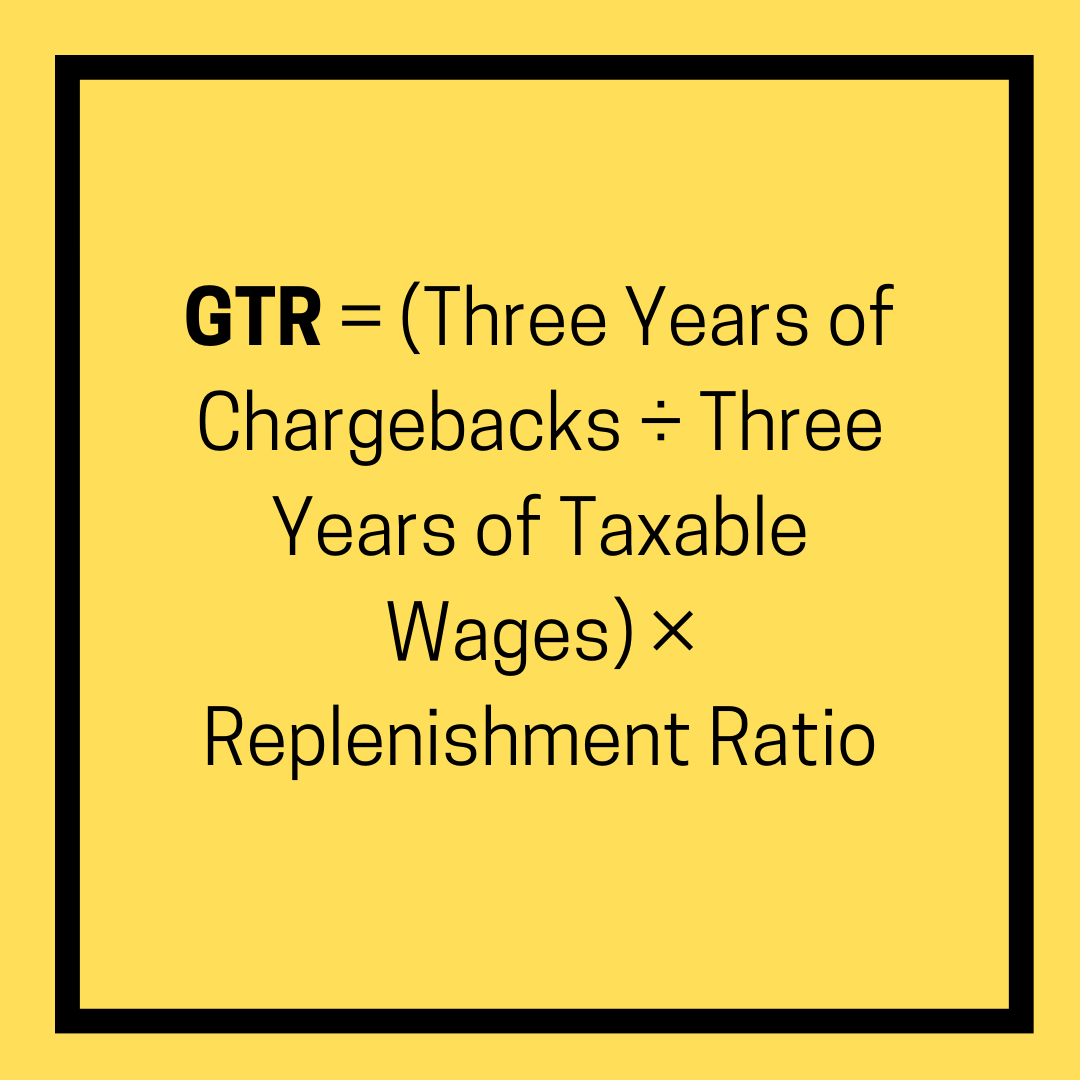

A Complete Guide To Texas Payroll Taxes

State Estate And Inheritance Tax Treatment Of 529 Plans

Property Tax Calculator Smartasset

Determining Illinois Estate Tax Rate Is Surprisingly Difficult

Es402 Introduction To Estate Gift Tax

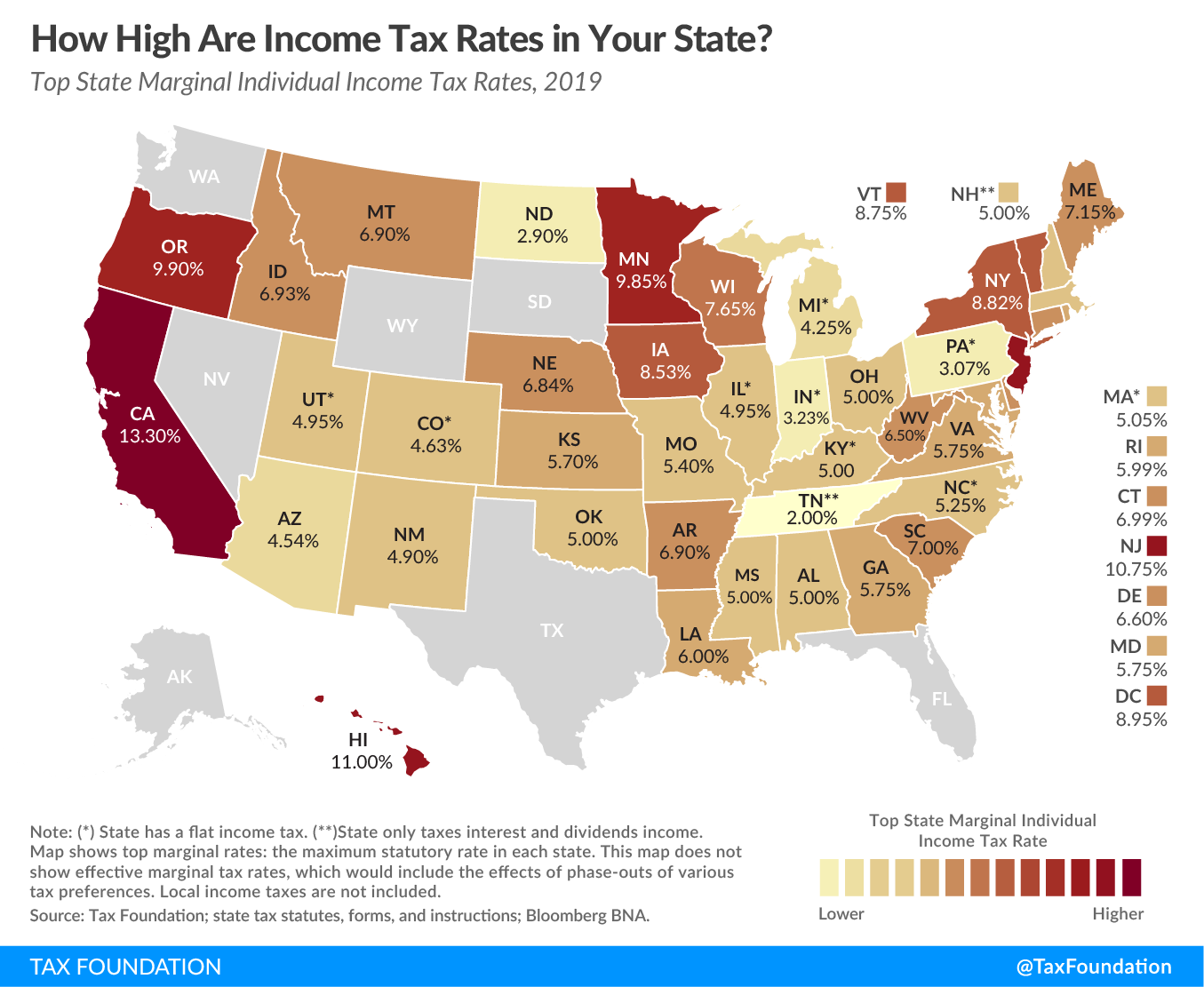

State Individual Income Tax Rates And Brackets Tax Foundation

Texas Income Tax Calculator Smartasset

Estate Planning 101 Your Guide To Estate Tax In Georgia

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

What Is The U S Estate Tax Rate Asena Advisors

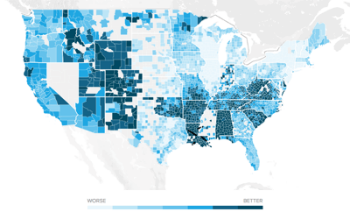

Property Taxes By State How High Are Property Taxes In Your State